Maximizing Revenue For Delivery Apps with Retail Media Ads

Retail Media

.

5 min read

Explore the role of targeted advertising offered by Retail Media in helping on-demand delivery platforms, including restaurant and grocery delivery apps, to increase monetization and offer highly personalized offers to meet the demands of today's consumers.

Delivery Apps: Rising Orders but Challenging Environment

The on-demand delivery industry, including restaurant and grocery delivery platforms, has emerged as a cornerstone of modern convenience, pushing the boundaries of quick commerce and innovative technologies.

Food delivery and ride-hailing players like Uber Eats, DoorDash, and Instacart have led the charge in the delivery industry in the US. At the same time, platforms like Delivery Hero, Careem, and Deliveroo dominate the landscape on the other side of the ocean, namely in Europe, the Middle East, and Africa.

Emerging players such as Ninja, Jahez, and Mrsool are taking the model even further, offering ultra-fast delivery options that promise to bring orders to customers in as little as 15 minutes. These platforms have changed the way consumers access their favorite restaurants and grocery stores, offering seamless, on-demand services online.

But behind this quick ordering experience that consumers enjoy hides complicated economic challenges. The rise of the quick commerce model has come with significant logistical and operational costs, placing companies in a precarious "life or death"situation and making the long-term sustainability and profitability elusive like a mirage.

Even industry leaders are not immune to these challenges. DoorDash, for example, has posted profits only once during the height of the pandemic, underscoring the financial strain delivery platforms face.

As Christopher Payne, Chief Operating Officer of DoorDash, puts it:“This is a cost-intensive business that is low-margin and scale-driven.”

Meanwhile, consumer expectations are evolving just as quickly as the industry itself. Not only are today’s consumers seeking speed and convenience but also increasingly expect personalized experiences when ordering online. They expect tailored recommendations and marketing campaigns that reflect their preferences, raising the bar for delivery platforms.

To make things even worse, add in the current macroeconomic pressures like rising inflation and geopolitical tensions, making the path to profitability even more uncertain for delivery platforms.

So, where do you go from here?

The Secret Monetization Sauce

While delivery platforms can reduce operational costs to inch towards the profitability path, there is another powerful tool: targeted advertising offered by Retail Media. By embedding Retail Media in their apps, these platforms are tapping into a new revenue stream, one that allows them to monetize the data they are already sitting on.

Uber Eats, Instacart, and Lyft have already embraced this shift by building their own ad businesses to offer restaurants, grocery stores, and other sellers multiple creative ad formats such as Sponsored Products and Display to promote their products directly to hungry shoppers who are in the mindset of making immediate orders.

As Dr. Mark Grether, VP and General Manager at Uber Advertising, explains the process:

"Advertisers bid on inventory, and ads are ranked based on click-through rates and conversions, ensuring more visibility in the Uber Eats feed. These ads integrate seamlessly into the user's experience, looking similar to organic content and enhancing, rather than disrupting, the browsing process."

With advanced targeting options, these ads reach users at the perfect moment, whether it is encouraging them to add a specific soda to a grocery order or suggesting chips with their burger delivery.

Join to get free updates every week

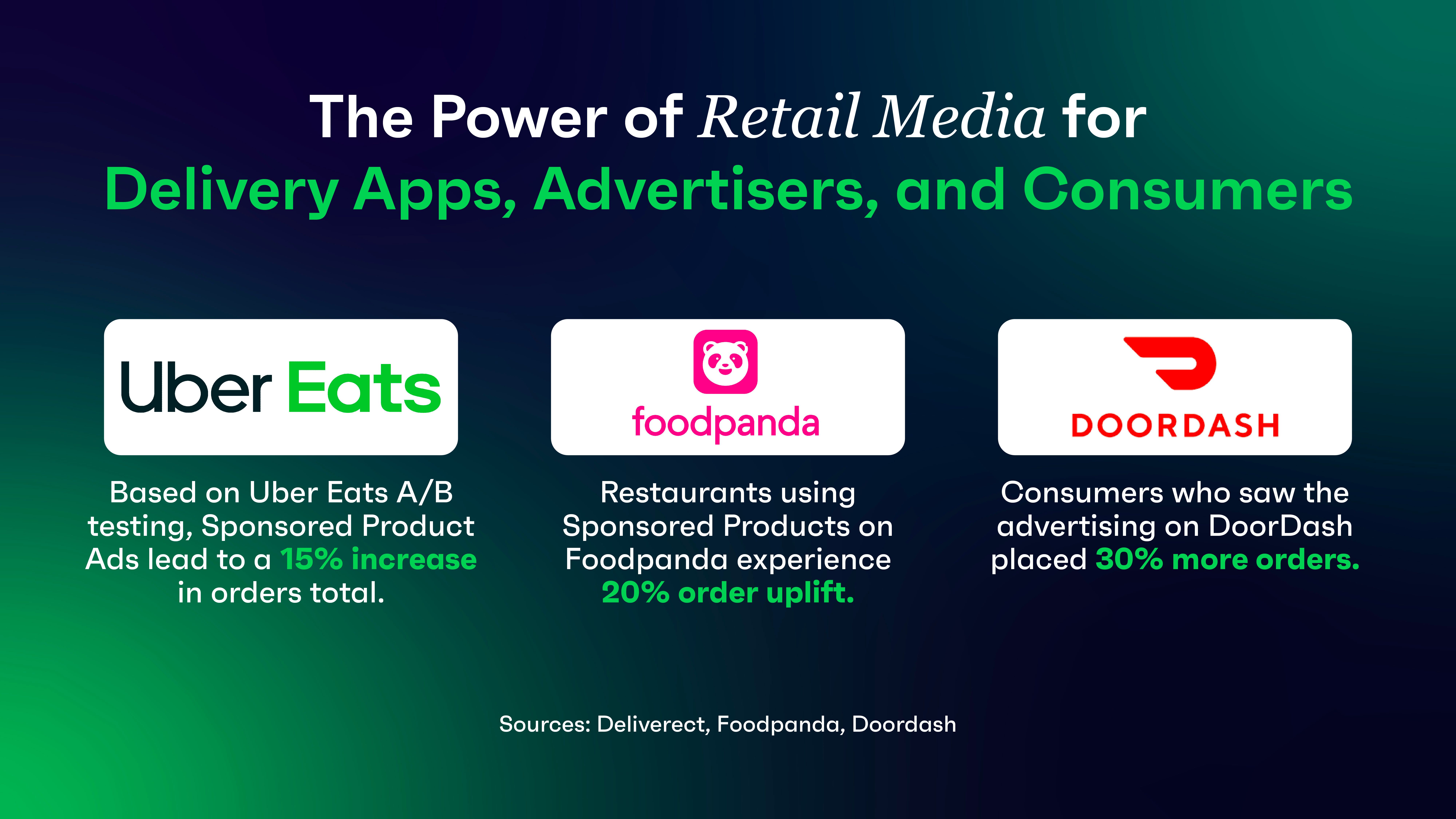

Can Retail Media Platforms Really Deliver?

The incremental revenue impact of advertising is already undeniable, with substantial sales lift from Retail Media for global and regional delivery platforms. Established only 2 years ago, Uber is already aiming for a $1 billion revenue goal for 2024. And, Instacart’ their Retail Media arm, Instacart Ads, is projected to bring $1.18 billion this year, growing 25.5% from the previous year.

Equally, global CPG and FMCG brands advertising on these leading platforms are also seeing exceptional return on investment. KFC campaigns on Uber Ads saw 84% sales uplift for their kid’s bucket sales. Using Sponsored Products, Nespresso’s campaignpromoting their coffee capsules and innovative machines on TeknoSa and a leading grocery platform, resulted in a 3,300% ROAS. Finally, Coca-Cola’s DoorDash campaign, for example, resulted in 89% sales uplift.

Forecasts provided by GroupM Nexus can give you an even bigger picture with the global Retail Media market expected to reach $160 billion by 2027, representing 25% of total advertising spend. Even more impressive is the profitability potential of Retail Media Ads: Sponsored Products, a.k.a Listings or Search Ads, coupled with Display Ads are expected to maintain above 80% EBIT margins across European networks through 2025.

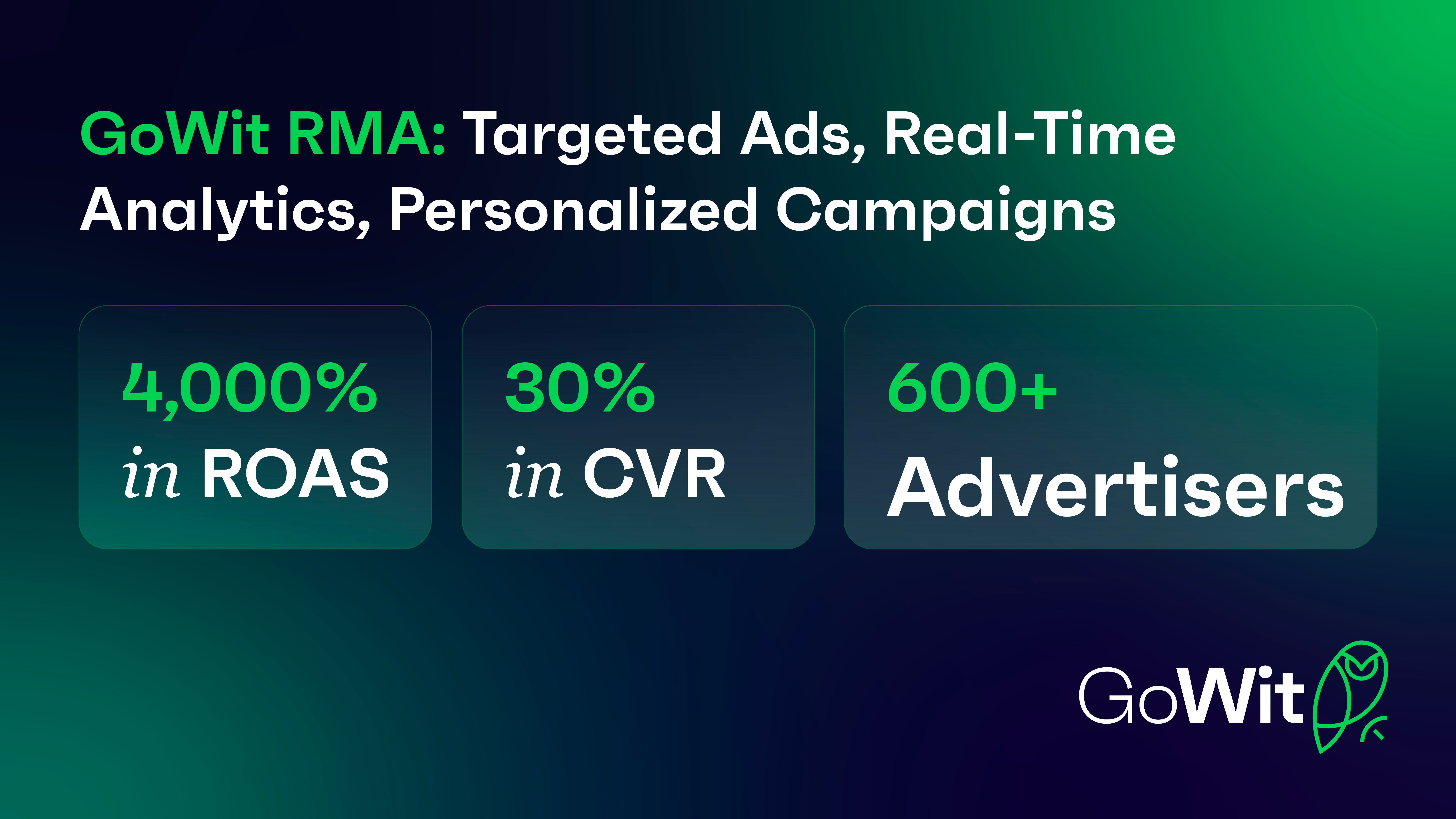

GoWit RMA: Your Recipe for Retail Media Success

Partnering with leading delivery platforms across MENA and Europe, GoWit has developed and optimized high-performance ad monetization businesses through its best-in-class AdTech - GoWit RMA. As consumer behavior increasingly leans toward delivery services and the competitive landscape tightens, GoWit RMA empowers delivery platforms to unlock the full potential of targeted advertising through:

- Personalized Ad Experience: Using geo, behavioral, category and keyword targeting, GoWit ensures that ads are delivered based on user preferences, creating highly relevant ad experiences that drive engagement.

- Increased Operational Efficiency: Auto Bidding, Auto Targeting, and Self-Service features allow you to automate manual workload associated with the campaign management, which is time-consuming and prone to errors. GoWit RMA is a solution that scales as your volume of ad ops grows.

- Real-Time Analytics: With access to real-time data, restaurants, CPG and FMCG advertisers can measure ad performance in a closed-loop way, make data-driven decisions, and continually improve the effectiveness of their strategies and maximize ROI.

Using GoWit RMA, our partners in the delivery sector and their advertisers have already achieved remarkable outcomes, and the numbers speak for themselves:

- 4,000% in ROAS on top-performing ad campaigns

- 30% in Conversion Rates for key user actions and purchases

- 600+ Advertisers smoothly onboarded, from big FMCGs, fast food chains to local vendors

When to Consider Adding GoWit RMA to Your Menu?

- Fast and easy integration is your priority. You have got to run your core business with no option for downtime and disruptions. GoWit RMA offers a free, self-service integration that can be done in 15 minutes or less that smoothly integrates into your existing systems, minimizing any disruption to your system.

- Ongoing support is necessary for your success. More often than not, it’s not just about implementing a system; it’s about growing with it. The GoWit team brings over 15 years of ad-tech experience, providing you with strategic and technical support every step of the way. From detailed technical documentations, dedicated Customer Success Manager and weekly check-in, you are all set for Retail Media success

- Continuous innovation is important for you to stay ahead of the pack. The delivery landscape is evolving fast, and you need a platform that not only keeps up with but stays ahead. GoWit RMA is constantly updated with cutting-edge features to meet the unique needs of fast-growing delivery platforms.

- A custom, white-label platform representing your delivery brand is required. Every business is different. With GoWit RMA, you can customize and white-label the platform to fit your brand and technical requirements, ensuring it aligns perfectly with your strategic objectives.

- Expanded ad formats are sought by your advertisers. Whether you’re looking for Sponsored Products, Display, Brand, Video or off-site programmatic ads, GoWit RMA offers omnichannel creative ad formats to increase engagement and conversions.

Conclusion: Retail Media is a New Revenue Driver for Delivery Platforms

The rise of retail media advertising within on-demand delivery apps is still in its early stages, but its potential is unquestionable. Leading giants like Uber Eat, Lyft and others have already launched their high-margin ad businesses to stay ahead of their competitors and offer more personalized deals to consumers. As the industry evolves, those players with high-performing ad businesses will be better positioned to generate revenue for their advertisers and cater personalized experiences for their consumers.

References:

- Coffee, P. (2023) WSJ News exclusive | lyft to expand its AD business as new CEO eyes a turnaround, The Wall Street Journal. Available at: https://www.wsj.com/articles/lyft-to-expand-its-ad-business-as-new-ceo-eyes-a-turnaround-c9554ef8 (Accessed: 17 October 2024).

- DoorDash Ads (2024) Grow your brand by reaching high-intent consumers (2024) DoorDash. Available at: https://about.doordash.com/en-us/marketing (Accessed: 17 October 2024).

- Kelly, C. (2022) Retail media makes up 11% of global ad spend, Groupm says, Marketing Dive. Available at: https://www.marketingdive.com/news/retail-media-global-ad-spend-groupm/632269/ (Accessed: 17 October 2024).

- McCoy, K. (2024) Uber’s $1 billion ad business expected to remain untouched amidst Google’s third-party cookie fallout, Digiday. Available at: https://digiday.com/marketing/ubers-1-billion-ad-business-expected-to-remain-untouched-amidst-googles-third-party-cookie-fallout/ (Accessed: 17 October 2024).

- Rana, P. and Haddon, H. (2021) Doordash and uber eats are hot. they’re still not making money. - WSJ, The Wall Street Journal. Available at: https://www.wsj.com/articles/doordash-and-uber-eats-are-hot-theyre-still-not-making-money-11622194203 (Accessed: 17 October 2024).

- Uber Ads (2024) KFC generates ‘Finger-Lickin’ Good’ sales, Uber Advertising. Available at: https://www.uber.com/us/en/advertising/ (Accessed: 17 October 2024).

Share