What brands think of Retail Media & What are their plans for 2023?

Brands

.

4 min read

Those brands that have already started utilizing Retail Media platforms will be able to produce more contextualized ads, develop deeper engagement, and boost brand visibility among the right consumers.

It’s a fact that Retail Media has become of great importance in recent years as retailers seek to monetize their e-commerce platforms and capitalize on their first-party data. For brands, this presents an opportunity to reach customers in a more targeted and measurable way, while also leveraging the data and insights provided by retailers.

A recent survey by the Association of National Advertisers (ANA) found that 73% of brands expect to spend more on Retail Media in the future than they do today. This aligns with the growth projections for the industry, with eMarketer predicting that ad revenue from Retail Media networks will reach $52 billion in 2023 and $61 billion next year in the US alone, accounting for one in five digital ad dollars spent by marketers.

Key Challenges In The Market For Brands

One of the key challenges for brands in this space is navigating the multiple Retail Media networks available to them. The ANA survey found that 56% of brands work with five or more different retail media networks, adding complexity to the decision-making process. This complexity is exacerbated by the fact that brands are both selling goods and advertising through retailers, requiring them to balance short-term sales goals with long-term brand-building initiatives.

Another challenge for brands is measurement and transparency. Brands want to see an improvement in transparency with results measured consistently across platforms. However, according to the ANA survey, brands still look for Retail Media networks that are optimized in a better way for their key performance indicators (KPIs). This leaves room for retailers to demonstrate their understanding of what brands are seeking from Retail Media and show how they are delivering, all while reducing complexity.

Join to get free updates every week

Expectations Of Brands

Despite these challenges, brands recognize the value of Retail Media and are eager to invest in them. In a recent report by eMarketer, brands indicated that the ability to reach high-intent shoppers and measure the effectiveness of campaigns were the top benefits of working with Retail Media. Additionally, according to eMarketer, brands see retail media as a way to differentiate themselves from competitors, with 44% of respondents citing this as a key benefit.

First-party audience data is what many brands are really into. Brands see consumer data as a significant chance, they collaborate with retailers and benefit from their first-party customer interactions. Furthermore, more and more brands demand working with retailers that have a multi-channel ad platform. Regarding the campaigns specifically, they seek to develop data-based, customized ad campaigns that are catered to their requirements by using retailer customer data as an alternative to third-party cookies. The ability to support co-marketing campaigns that reinforce and improve purchase strategies is essential for them.

What are the Retail Media plans of brands in 2023?

Those brands that have already started utilizing Retail Media platforms will be able to produce more contextualized ads, develop deeper engagement, and boost brand visibility among the right consumers.

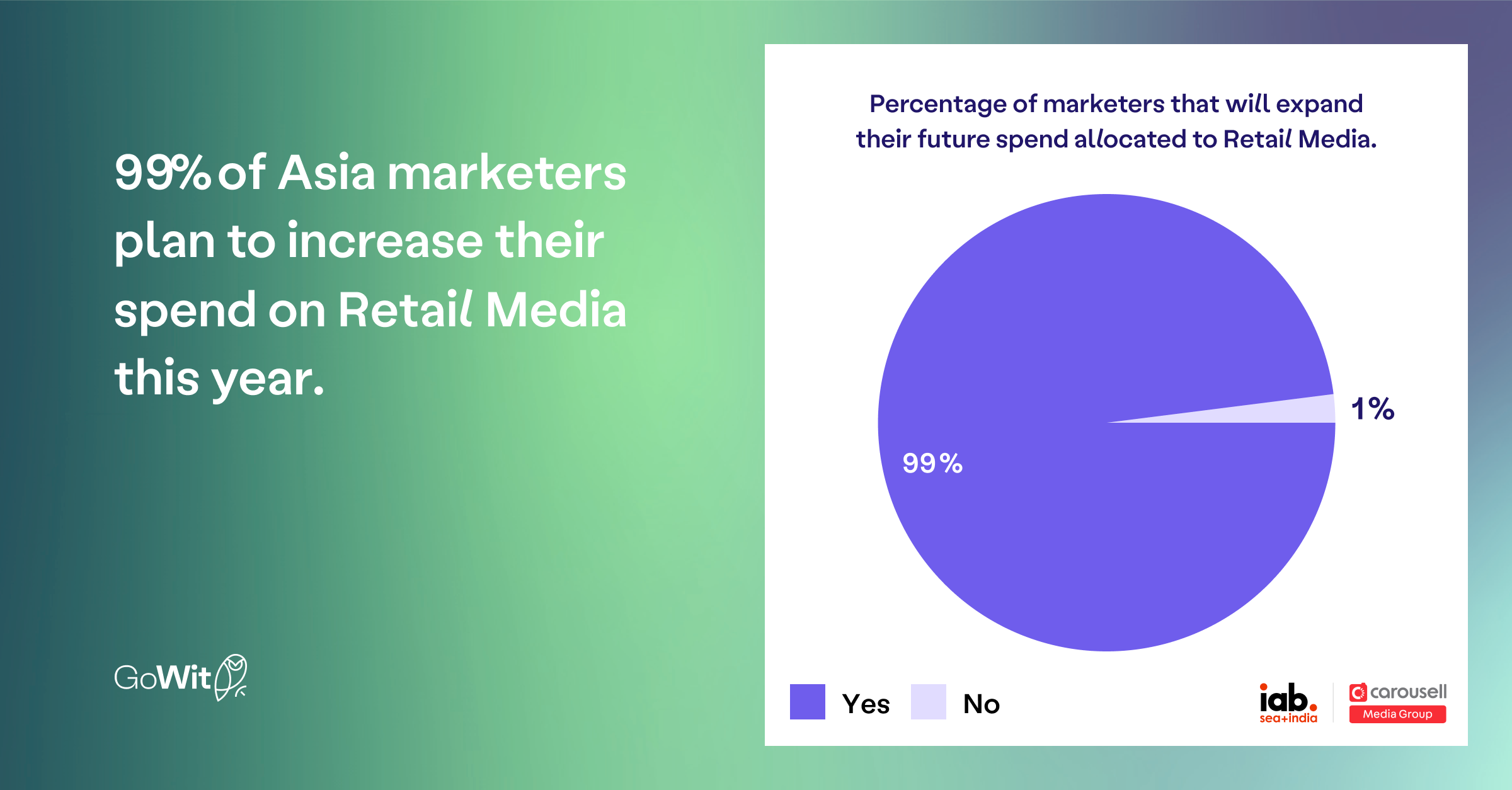

Retail Media will continue to be in high demand for brands and they will continue to invest in it in the future. According to a new study by Carousell Media Group, Interactive Advertising Bureau Southeast Asia and India (IAB SEA+India), 99% of Asia-based marketers will increase their retail media spend in 2023.

This result is not surprising as Retail Media is ultimately a very effective tool that enhances brand improvement and profit. Brands get access to a variety of first-party data that is unique and comprehensive. They hold the power to customize ad experiences for their customers and increase conversions by utilizing data. On top of that, scale, efficiency, and performance for brands will increase even more when the omni-channel services of Retail Media platforms are managed through a unified approach.

Like mentioned before, while keen to invest in Retail Media, businesses are also experiencing difficulties as they manage different networks and attempt to find a balance between their sales targets and brand-building strategies that will drive lasting benefits. In this scenario, retailers will need to show that they’re aware of what brands want from them and the ad platforms they provide, as the industry continues to develop continually.

References:

“99% of Asia Marketers Increasing Retail Media Spend Says New Research Report.” IAB Southeast Asia and India, www.iabseaindia.com/blog/99-of-asia-marketers-will-increase-their-retail-media-spend-says-new-research-by-carousell-media-group-and-iab-seaindia. Accessed 31 Mar. 2023.

Schiff, Allison. “Brands Want to Spend More on Retail Media, but They Have a Few Requests.” AdExchanger, 8 Feb. 2023, www.adexchanger.com/retail-media/brands-want-to-spend-more-on-retail-media-but-they-have-a-few-requests-first/. Accessed 31 Mar. 2023.

“What Is Retail Media and How Will Brands Use It in 2023? | LBBOnline.” Www.lbbonline.com, www.lbbonline.com/news/what-is-retail-media-and-how-will-brands-use-it-in-2023.

“Why Retail Media Is the Hottest New Kid on the Digital Media Block — Exchange4media.” Exchange4media, www.exchange4media.com/marketing-news/why-retail-media-is-the-hottest-new-kid-on-the-digital-media-block-126283.html. Accessed 31 Mar. 2023.

Share