Navigating $3.75 Billion Retail Media Market in MENA: Insights For Retailers and Advertisers

Retail Media

.

8 min read

The $3.75 billion MENA Retail Media market is rapidly transforming, with Saudi Arabia and the UAE leading in digital engagement, while Egypt and Kuwait offer emerging opportunities. As ad spend continues to grow, retail, CPG and MarTech leaders must adapt to country-specific trends and leverage data-driven strategies to maximize impact and drive profitability in this dynamic landscape.

The MENA region’s digital advertising landscape is evolving at a rapid pace, driven by growth in e-commerce and Retail Media.

According to Statista:

- Retail Media ad spend in the Middle East and Africa is projected to reach $3.75 billion by 2025.

- The e-commerce market is expected to hit $109.99 billion in the same year.

While the U.S. and Europe currently lead the sector, the MENA region is emerging as the fastest-growing market. In the United States, home to retail giants like Amazon, Walmart, and Target, the market is projected to reach $71.11 billion by 2025. Following the U.S., Europe is expected to hit $29.00 billion in the same period. These high figures are largely driven by strong internet penetration rates and the presence of dominant global retailers.

According to IAB MENA, while the U.S. and Europe benefit from a mature Retail Media ecosystem, bolstered by Amazon’s first-mover advantage and advanced e-commerce infrastructure, retailers in the Middle East and North Africa are quickly adopting Retail Media strategies. As a result, the MENA region is emerging as a strong competitor, closing the gap with Western markets.

Despite the dominance of in-store shopping in the region, particularly in markets like Egypt and Kuwait where over 80% of purchases still happen offline, digital shopping is expanding rapidly. The rise of mobile commerce, digital payments, and AI-driven personalization is reshaping consumer behaviors across the region. Retailers must strike a balance between enhancing in-store experiences and leveraging digital-first strategies to capture evolving consumer expectations.

As countries like Saudi Arabia, the UAE, Egypt, and Kuwait experience country-specific digital growth, brands can tailor their strategies to align with localized trends and consumer behaviors.

Saudi Arabia ranks first in Retail Media ad spend, highlighting its strong digital engagement and high consumer demand. The UAE follows as a second major hub, with a fast-growing e-commerce sector and substantial Retail Media investments, solidifying its role in the region.

Egypt and Kuwait as two emerging markets present new opportunities for marketing professionals to engage with a highly connected, digitally savvy audience. This dynamic landscape makes Retail Media an essential tool for maximizing brand visibility, engagement, and overall market success.

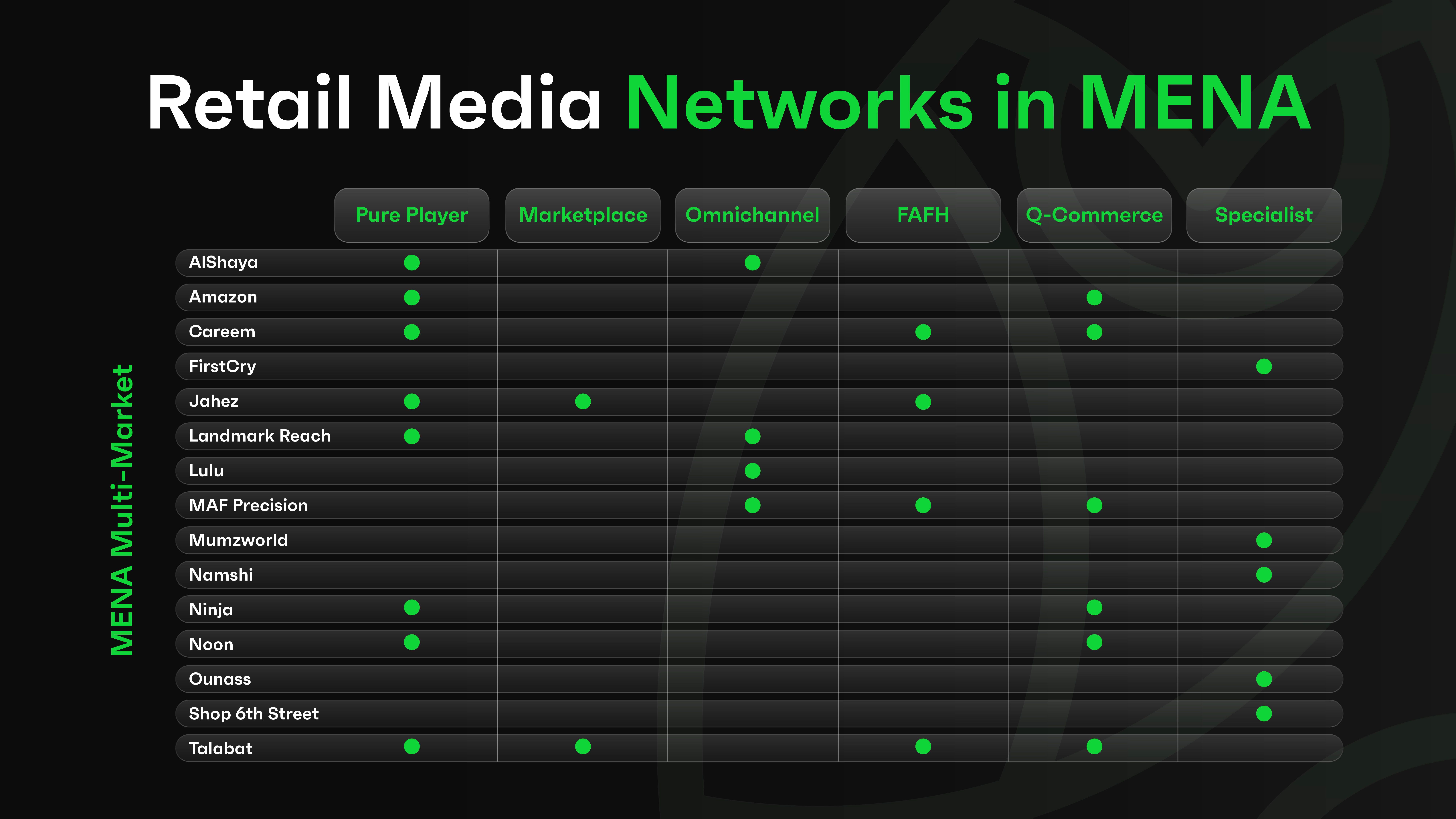

Retail Media Network (RMN) Ecosystem in MENA

Following the global trend, the Retail Media Network (RMN) ecosystem in MENA is gaining stronger traction, with businesses adopting various inventory procurement models to maximize ad revenue and engagement.

According to IAB MENA, these models can be categorized into the following:

- Pureplay Retailers – These companies leverage their own digital ad inventory, allowing brands and distributors to advertise directly on their platforms.

- Marketplaces – These retailers extend their advertising reach by tapping into networks of brick-and-mortar stores, creating a hybrid ad ecosystem.

- Omnichannel Retailers – Operating both online and offline, these retailers integrate digital and in-store advertising to provide seamless brand experiences.

Beyond inventory procurement, RMNs in MENA are also diversifying based on delivery and specialization models:

- Food Away from Home (FAFH) – Retailers aggregating restaurant networks to enable food delivery advertising.

- Quick Commerce (Q-Commerce) – Businesses focused on ultra-fast delivery, leveraging RMNs to target high-intent consumers at the moment of purchase.

- Specialized Retailers – Brands catering to niche markets such as healthcare, fashion, and electronics, providing advertisers with highly targeted ad placements.

As the RMN market matures, the distinctions between these categories are becoming increasingly blurred. Companies are adopting hybrid models, integrating multiple approaches to optimize ad revenue and shopper engagement.

Retail Media Ad Formats in MENA

Retail Media in MENA is characterized by the growth of onsite and off-site retail advertising, increased investment in AI and data analytics, and a growing focus on closed-loop measurement.

To target high-intent consumers at the time of purchase, brands are increasingly utilizing third-party networks, in-store advertising, and retailer-owned digital platforms. The industry is also seeing an expansion in demand-side platforms and programmatic solutions, allowing advertisers to optimize campaigns in real-time.

To increase returns on ad spend (ROAS) and foster deeper consumer connection, retailers in the region are developing more individualized and measurable advertising solutions as they develop their Retail Media strategy.

Shoppers in the MENA Region

The growth of the MENA region is driven by rapid urbanization and an expanding tech-savvy population that consistently seeks innovative, engaging, and high-impact experiences. The increasing adoption of mobile commerce and digital payments has accelerated the shift toward online shopping, making digital-first strategies more essential than ever.

With a highly connected consumer base and a competitive market filled with numerous brands and retailers, the demand for personalization is at an all-time high. MENA consumers expect a seamless, tailored shopping journey, where convenience and relevance shape their purchasing decisions.

Join to get free updates every week

Country-Specific Market Insights

The rapid growth of Retail Media and e-commerce in the MENA region presents a valuable opportunity for retailers and brands. By analyzing country-specific trends, businesses can develop more targeted and effective strategies, maximizing their marketing impact in key markets.

Retail Media in Saudi Arabia

Saudi Arabia stands at the forefront of Retail Media innovation, with an evolving e-commerce industry that is projected to reach $16.53 billion, while the Retail Media sector is expected to grow to $821.90 million by 2025. This surge is fueled by high internet penetration, a digitally engaged population, and evolving consumer expectations.

The Saudi Consumer

- Digital engagement: 91% of consumers prefer online shopping, with 14% making daily purchases.

- Preferences: 73% of shoppers are deal seekers and value products with promotions

- Offline vs. online shopping: In-store shopping dominates with 66% of shoppers still preferring the physical shopping experience

- Loyalty: Loyalty to local brands is high as 71% of shoppers prefer Saudi-based products

Opportunities for Brands and Retailers

- Endemic Brands can leverage Retail Media to stand out in a highly competitive landscape, boosting visibility and sales.

- Non-Endemic Brands can have a unique opportunity to reach new audiences by tapping into Saudi Arabia’s high-intent digital shoppers.

- Omnichannel strategies that merge online and offline experiences will be essential in maintaining a competitive edge.

Retail Media Networks in Saudi Arabia

Saudi Arabia’s top Retail Media players include Al-Dawaa Medical, Mumzworld, Danube, HungerStation, Nahdi Pharmacy, Panda Retail, and Tamimi Markets. These platforms offer advertisers access to high-intent shoppers through a mix of display ads, sponsored product placements, and loyalty-based advertising.

Retail Media in United Arab Emirates (UAE)

The UAE is at the forefront of digital transformation in the MENA region, with the highest internet penetration rate among MENA countries. As a leading economic hub, the country’s e-commerce market is expected to reach $17 billion by 2025, contributing significantly to the MENA market, which is valued at $50 billion in 2024.

This rapid digital and economic growth is also reflected in the Retail Media market, where ad spending in the UAE is projected to reach $365.13 million in 2025. With a high gross merchandise value (GMV) of online sales and an accelerating growth rate, the UAE is solidifying its position as a key player in the evolving Retail Media landscape.

The UAE Consumer

- Digital engagement: internet penetration rate is over 99%

- Preferences: 72% of UAE shoppers prioritize quality and convenience over price and are willing to pay more for premium products, while Saudi Arabia and other markets are more price-sensitive

- Seamless shopping journeys: With a strong omnichannel presence, consumers expect personalized recommendations and real-time engagement across platforms.

Key Retail Media Trends in the UAE

- Integration of Online and Offline Channels: Seamless omnichannel experiences are becoming the norm.

- High Internet Penetration: The digital-savvy population drives online engagement.

- Growing Popularity of Online Marketplaces: Platforms like Instashop and el Grocer are reshaping shopping habits.

- Accelerated Digital Transformation: AI, data analytics, and automation are revolutionizing the industry.

- Personalized Customer Experience: Consumers expect tailored ads and product recommendations.

UAE’s Retail Media Network

Retailers and advertisers can capitalize on consumer behavior insights, leveraging digital platforms for maximum reach. With major players like Mumzworld, Aster Pharmacy, Deliveroo, el Grocer, Instashop, Life Pharmacy, and Spinneys, the UAE is poised to lead the Retail Media market well into 2025, offering significant growth potential for brands looking to engage with an increasingly digital-first consumer base.

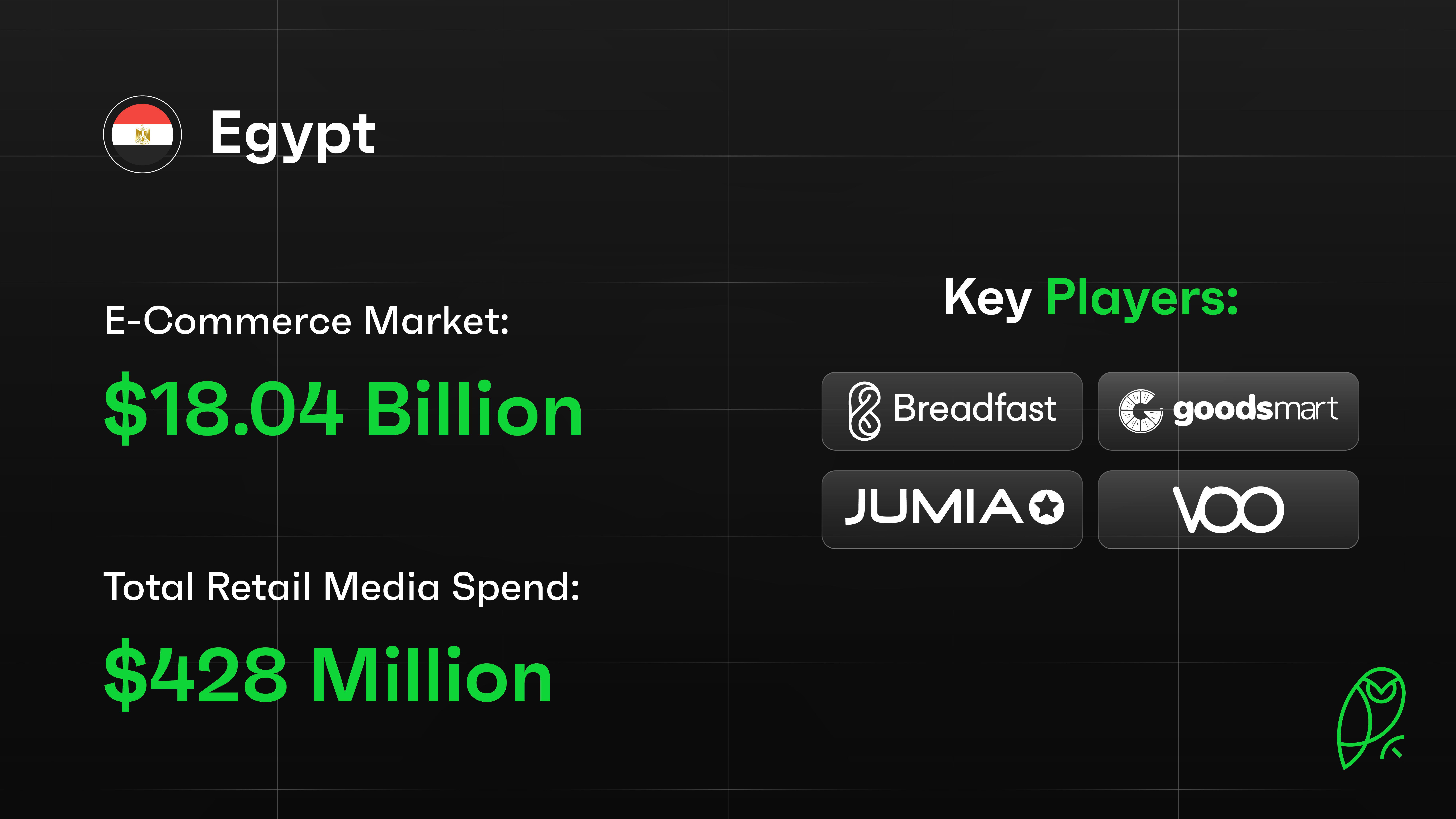

Retail Media in Egypt

Egypt is one of the fastest-growing Retail Media and e-commerce markets in MENA, with the e-commerce sector projected to reach $18.04 billion by 2029. Furthermore, Retail Media ad spend is expected to hit $428 million by 2025, positioning Egypt as the third-largest Retail Media market in MENA.

The Egyptian Consumer

- Digital engagement: 72.2% internet penetration rate

- Online vs. offline: 93% of consumers prefer physical shopping experience, highlighting the importance of in store shopping habits in Egypt

- Preferences: 67% of consumers cite inflation as a major concern, making promotions and value-based advertising most preferred factors in shopping

- AI trust is rising, over half of consumers rely on AI-driven recommendations for low-risk product choices.

Key Retail Media Insights in Egypt

- Booming Digital Advertising Market: Projected to reach $1.79 billion by 2025.

- High-Growth Ad Formats: Investments in search and banner ads fuel market expansion.

- Large and Growing Online Population: Digital engagement continues to rise, creating more opportunities for brands.

Egypt’s Retail Media Networks

With leading Retail Media players like Etmana, Breadfast, Goodsmart, Jumia, and Voo, Egypt presents a tech-driven consumer base and increasing investments in digital infrastructure. Brands have a prime opportunity to leverage Retail Media for deeper engagement and higher conversions, tapping into Egypt’s expanding digital ecosystem.

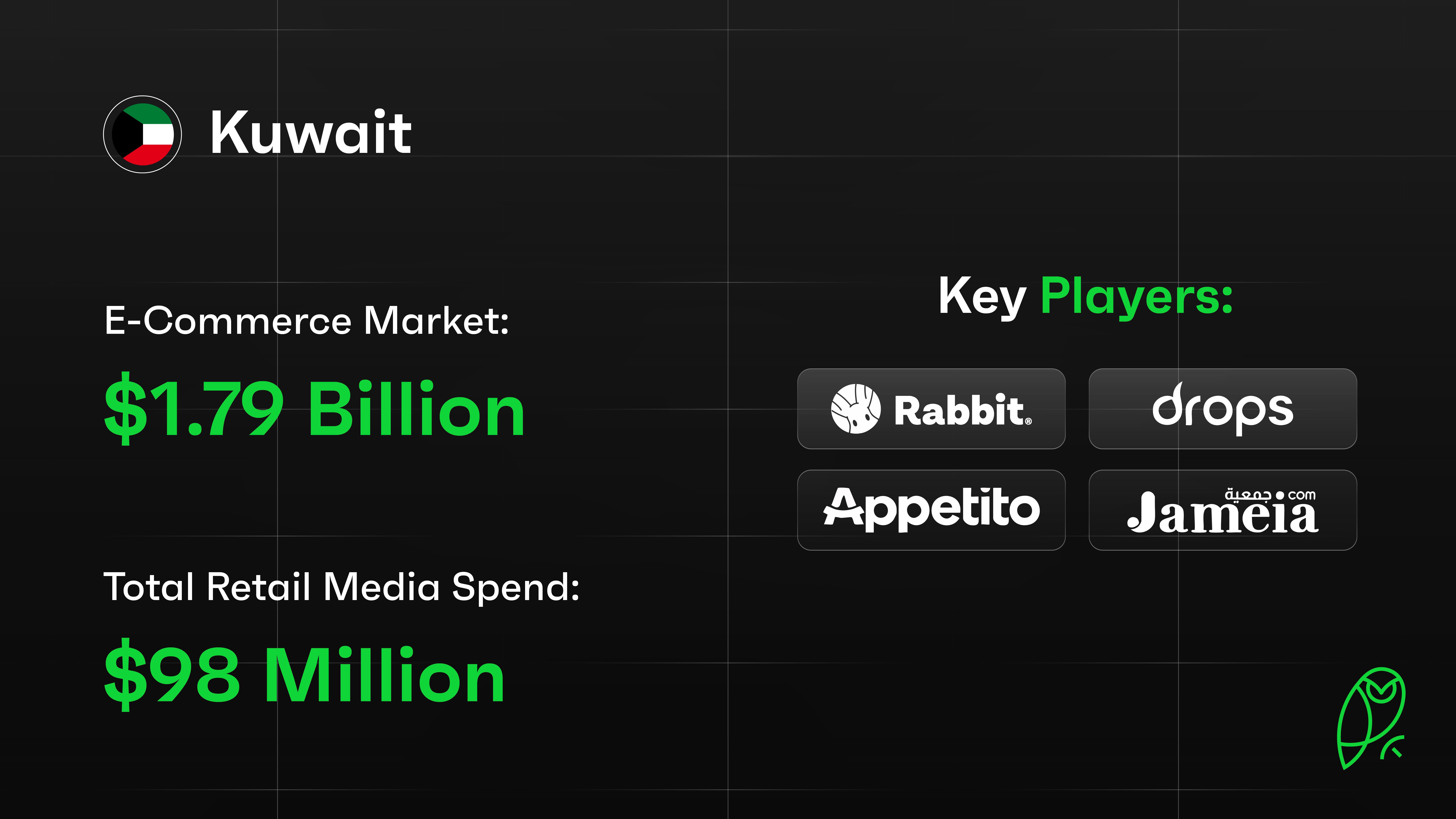

Retail Media in Kuwait

Kuwait’s e-commerce market is on the rise, expected to grow from $1.79 billion in 2025 to $2.39 billion by 2029. With high internet penetration and a socially active population, brands have an opportunity to engage with high-intent digital shoppers. In Kuwait, ad spending into Retail Media platforms is expected to increase to almost $98 million in 2025.

The Kuwaiti Consumer

- Digital engagement: 99.7% internet penetration rate

- Online vs. offline: 86% of shoppers prefer in-store shopping, showing a strong demand for retail-driven, in-store promotions.

- Preferences: 53% of shoppers seek relevant product promotions, reinforcing the need for targeted digital advertising.

- Loyalty: Brand loyalty is high, with 60% of shoppers preferring familiar brands, though the rest are open to exploring new products with strong promotional offers.

Key Retail Media Insights in Kuwait

- Seamless Omnichannel Advertising – Retail Media enables onsite, in-store, and off-site ad integration, extending brand reach across multiple touchpoints.

- Data-Driven Monetization – Retail Media empowers e-commerce players with efficient ad monetization and streamlined data management, all while maintaining privacy compliance.

Retail Media Networks in Kuwait

Key Retail Media players like Appetito, Drops, Jameia, and Rabbit, primes Kuwait for growth in digital marketing. Brands can leverage Retail Media to maximize ad efficiency, enhance customer engagement, and drive sales, tapping into a highly connected and digitally savvy market.

In summary, the MENA region’s Retail Media and e-commerce boom presents immense opportunities for brands and retailers. With country-specific trends shaping consumer behavior, businesses that adapt to local demands will thrive. From Saudi Arabia’s digital surge to Kuwait’s data-driven advancements, personalization and innovation are key. To stay competitive, brands must embrace Retail Media, digital transformation, and tailored customer experiences, unlocking the region’s full potential.

Sources

Checkout.com. "E-Commerce Enters High-Growth Stage in Saudi Arabia’s Thriving Digital Economy." Checkout.com. Accessed March 19, 2025. https://www.checkout.com/newsroom/e-commerce-enters-high-growth-stage-in-saudi-arabias-thriving-digital-economy.

Ipsos. "Spotlight Kuwait: Shopper Behaviour & Attitudes 2024." Accessed March 19, 2025. https://www.ipsos.com/sites/default/files/ct/news/documents/2024-01/Spotlight%20Kuwait%20-%20Shopper%20Behaviour%20%26amp%3B%20Attitudes_0_0.pdf.

PwC. "Voice of the Consumer 2024 Survey: Egypt Findings." Accessed March 19, 2025. https://www.pwc.com/m1/en/publications/voice-of-the-consumer-2024-survey-egypt-findings.html#:~:text=Shopping%20behaviours&text=But%20despite%20the%20growth%20of,to%20encourage%20in%2Dstore%20shopping.

Statista. "Digital Buyer Penetration in the United States." Accessed March 19, 2025. https://www.statista.com/statistics/273958/digital-buyer-penetration-in-the-united-states/.

Statista. "E-Commerce: Kuwait." Accessed March 19, 2025. https://www.statista.com/outlook/emo/ecommerce/kuwait.

Statista. "E-Commerce: MENA." Accessed March 19, 2025. https://www.statista.com/outlook/emo/ecommerce/mena.

Statista. "E-Commerce: Saudi Arabia." Accessed March 19, 2025. https://www.statista.com/outlook/emo/ecommerce/saudi-arabia.

Statista. "E-Commerce in the United Arab Emirates." Accessed March 19, 2025. https://www.statista.com/topics/7072/e-commerce-in-the-united-arab-emirates/.

Statista. "Retail Platform Advertising: Europe." Accessed March 19, 2025. https://www.statista.com/outlook/amo/advertising/retail-platform-advertising/europe.

Statista. "Retail Platform Advertising: Egypt." Accessed March 19, 2025. https://www.statista.com/outlook/amo/advertising/egypt.

Statista. "Retail Platform Advertising: MENA." Accessed March 19, 2025. https://www.statista.com/outlook/amo/advertising/retail-platform-advertising/mena.

Statista. "Retail Platform Advertising: Saudi Arabia." Accessed March 19, 2025. https://www.statista.com/outlook/amo/advertising/retail-platform-advertising/saudi-arabia.

Statista. "Retail Platform Advertising: United States." Accessed March 19, 2025. https://www.statista.com/outlook/amo/advertising/retail-platform-advertising/united-states.

Zawya. "State of the Nation Report for H1 2024 Released." Accessed March 19, 2025. https://www.zawya.com/en/press-release/research-and-studies/state-of-the-nation-report-for-h1-2024-released-sdk6058e.

Share